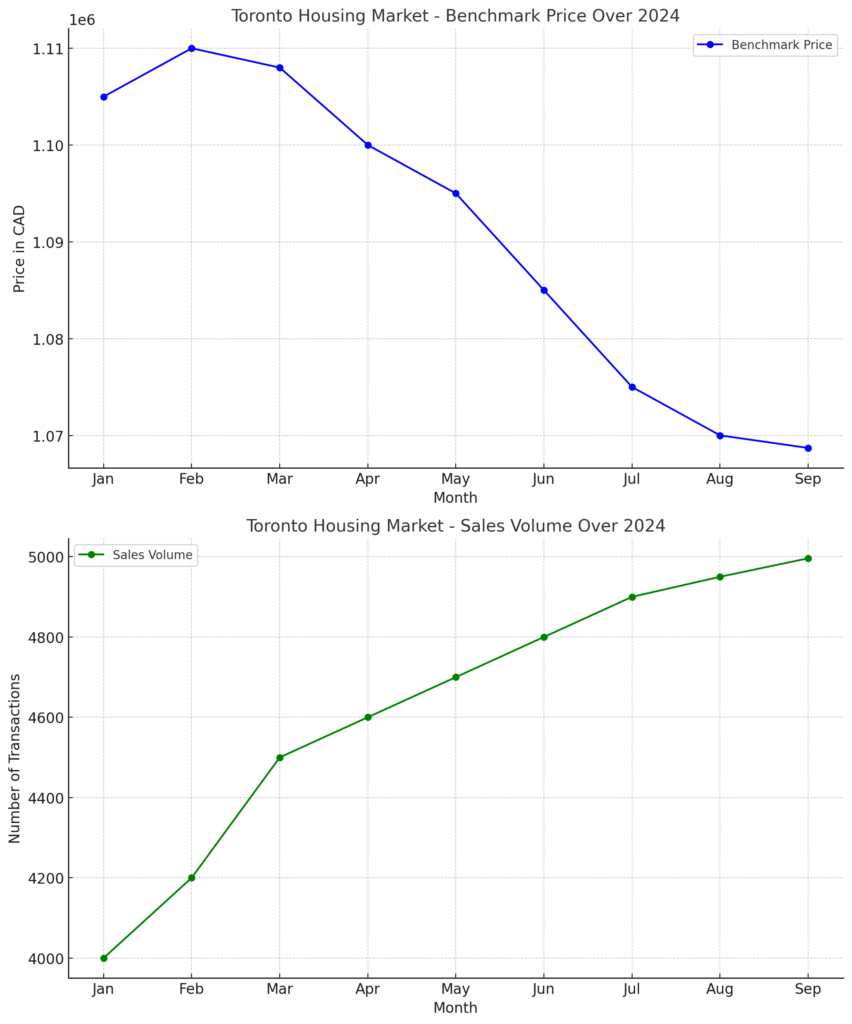

September saw notable shifts in Toronto’s housing market as falling prices and rising sales painted a dynamic picture. According to the Toronto Regional Real Estate Board (TRREB), the benchmark home price dropped by 4.58% compared to the previous year, bringing it down to $1,068,700. Despite this, home sales surged by 8.5%, with 4,996 transactions in September, compared to 4,606 in the same month last year.

The TRREB, which represents over 73,000 members, pointed to lower interest rates and reduced home prices as key factors driving more buyers back into the market. The number of new listings also rose by 10.5%, reaching a total of 18,089 in September.

Price Trends in Townhomes and Condos

Townhomes, a favorite among first-time homebuyers, experienced the steepest price drop, falling by 4% to an average price of $904,200. Condo apartments followed with a 3.6% decrease, now averaging $682,543.

TRREB’s chief market analyst, Jason Mercer, noted that buyers have been able to negotiate more favorable prices, particularly in the more affordable segments like condos and townhouses, leading to these moderate price declines.

Market Conditions Improving for Buyers

TRREB President Jennifer Pearce highlighted that as borrowing costs ease and mortgage guidelines become more flexible, more potential buyers are re-entering the market. “Every rate cut brings a greater number of GTA households closer to realizing their homeownership dreams,” Pearce said.

John DiMichele, TRREB’s chief executive, also welcomed recent changes to mortgage guidelines that allow for longer amortization periods and more options for homes priced above $1 million. He believes these adjustments will support a healthier, more balanced housing market in the Greater Toronto Area.

Changes Across Canada

Beyond Toronto, other Canadian cities also reported notable changes in their housing markets. Calgary saw sales drop by 17% compared to last year’s record high, though they remained 16% above typical September levels. New listings in Calgary rose to 3,687, creating a more balanced market. Ann-Marie Lurie, chief economist at the Calgary Real Estate Board (CREB), explained that the increase in listings, especially in higher price ranges, coupled with lower lending rates, should help sustain demand throughout the fall.

Meanwhile, Vancouver experienced a 3.8% decline in home sales, with 1,852 transactions in September. Andrew Lis, director of economics and data analytics at the Greater Vancouver Realtors (GVR), noted that while the reduction in mortgage rates had sparked hope for renewed demand, the September data didn’t yet show the anticipated rebound.

As these shifts continue to unfold, all eyes remain on how future interest rate changes and evolving market conditions will impact Canada’s housing markets heading into the fall season.